ANALISIS POLA KORELASI HARGA DAN VOLUME SAHAM BBCA MENGGUNAKAN ALGORITMA APRIORI

DOI:

https://doi.org/10.31949/j-ensitec.v11i02.13792Abstract

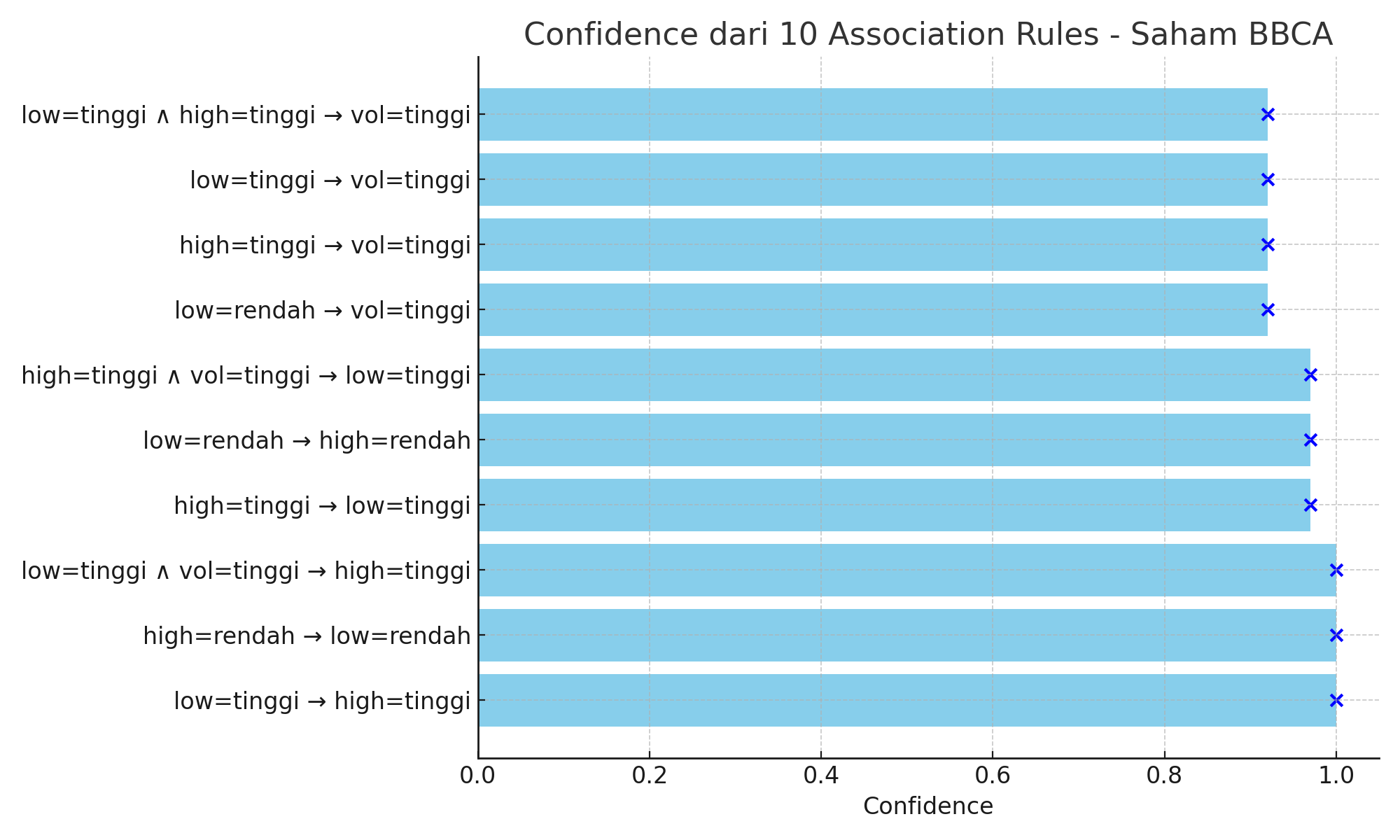

This study will determine the stock movement pattern of PT Bank Central Asia Tbk (BBCA) using Association Rule Mining according to the Apriori algorithm. The main focus is to investigate the correlation of the lowest price, the highest price, and the trading volume of BBCA shares in one time period. Past stock data is first processed and discretized into categorical data: lowest and highest, on each attribute. The data mining process is carried out using WEKA software to generate association rules with very high confidence values and lift values. Mining produces the top 10 association rules, some of which have 100% confidence values and lift values greater than 1, indicating a very strong relationship between the attributes. For example, it is found that when the lowest price is in the "high" category, the highest price is also high with absolute confidence. These observations indicate that BBCA stock behavior can be inferred through correlations between simple technical variables. This can help investors and market analysts to identify hidden patterns and make informed decisions based on evidence. This approach in the future can be complemented with other technical indicators such as Moving Average and RSI for more accurate predictions. This method offers practical value for investors by revealing hidden patterns and supporting data-driven decision-making, especially when combined with other technical tools like Moving Average and RSI.

Keywords:

association rule mining, BBCA, Apriori, Stock Data Analysis, Association Rule Mining, BBCA, Apriori, Stock Data AnalysisDownloads

References

[1] J. A. Azhar, N. Cantika, P. Kadua, and R. D. Safitri, ‘Analisis Persepsi Generasi Z Terhadap Investasi Berbasis ESG (Enviromental, Social, and Governance) di Jakarta Islamic Index’, Journal of Business Management and Islamic Banking, vol. 02, no. 01, pp. 77–94, 2023, doi: 10.14421/jbmib.

[2] I. A. Roziqoh, ‘Analisis Literasi Keuangan Syariah Bagi Investor Saham Syariah: Studi Kasus Di Galeri Investasi BEI UIN Walisongo Semarang’, 2023.

[3] M. Iqbal, ‘Pengaruh Literasi Keuangan Syariah Terhadap Minat Investasi Crypto Pada Generasi Z Di Kota Banda Aceh’, 2025.

[4] A. T. Putra, ‘Pengaruh Layanan Sekuritas Investasi Digital, Preferensi Risiko Dan Literasi Keuangan Syariah Terhadap Minat Mahasiswa Dalam Berinvestasi Saham Syariah Di Pasar Modal’, 2022.

[5] M. R. Sari, ‘Keputusan Investasi Milenial Perspektif Pengetahuan Keuangan, Perilaku Keuangan Dan Sikap Keuangan’, 2021.

[6] K. Intan, S. Sari, W. Utami, N. Yudi, and A. Wijaya, ‘Penerapan Data Mining Dalam Penentuan Strategi Marketing Menggunakan Algoritma K-Means (Studi Kasus: PT BPR Hoki)’, 2024.

[7] S. Amalia Tussifah and F. Sains Dan Teknologi, ‘Analisis Perbandingan Kinerja Model Arima, LSTM Dan GRU Pada Stock Price Forecasting Skripsi Oleh Program Studi Teknik Informatika’, 2022.

[8] C. A. Windani, ‘Strategi dan Tantangan Era Big Data bagi Masyarakat Modern’, Deviance Jurnal Kriminologi, vol. 7, no. 2, p. 101, Dec. 2023, doi: 10.36080/djk.2385.

[9] O. Pratama and J. H. Jaman, ‘Penerapan Data Mining Menggunakan Algoritma Apriori Untuk Mengetahui Kebiasaan Konsumen Dan Prediksi Stok Produk’, JATI (Jurnal Mahasiswa Teknik Informatika), vol. 7, no. 3, pp. 1837–1844, 2023.

[10] A. Wijaya, A. Faqih, D. Solihudin, C. L. Rohmat, and S. E. Permana, ‘Penerapan Association Rules Menggunakan Algoritma Apriori Untuk Identifikasi Pola Pembelian’, JATI (Jurnal Mahasiswa Teknik Informatika), vol. 7, no. 6, pp. 3871–3878, 2023.

[11] R. D. Parinduri, S. Defit, and G. W. Nurcahyo, ‘Implementasi Algoritma Apriori dalam Data Mining untuk Optimalisasi Stok Obat di Apotik’, Jurnal KomtekInfo, pp. 89–97, 2024.

[12] M. A. Al-fath, ‘Analisis Pengaruh Inflasi, Earning Per Share, Market Value, Variance Return, Dan Dividend Payout Ratio Terhadap Holding Period Saham (Studi Empiris Pada Perusahaan Tercatat Indeks LQ-45 Tahun 2016-2018)’, 2019.

[13] F. STIE Persada Bunda, ‘Pengaruh Closing Price Terhadap Abnormal Return Pada Saham LQ45 (Perusahaan Yang Melakukan Pengumuman Deviden Tahun 2010 Di BEI)’, vol. 1, no. 77, 2017.

[14] Fatchurrochim, ‘Analisis Pengaruh Profitabilitas, Solvabilitas, Suku Bunga, Dan Kurs Rupiah Terhadap Harga Saham Dengan Inflasi Sebagai Variabel Moderasi’, 2017.

[15] A. W. H. Utama, ‘Inflasi Memoderasi Pengaruh Profitabilitas Terhadap Harga Saham (Studi Empiris Pada Sub Sektor Restoran, Hotel & Pariwisata Yang Terdaftar Di BEI Periode 2014-2018)’, 2014.

[16] Riswandi, D. Ernawati, and A. Mulyadi, ‘Analisis Manajemen Risiko Operasional Bongkar Muat Menggunakan Metode HOR’, Jurnal Ensintech, vol. 7, no. 2, pp. 123–130, 2021, [Online]. Available: https://ejournal.unma.ac.id/index.php/j-ensitec/article/view/2302.

[17] D. Sari and E. Suhartono, ‘Analisis Bullwhip Effect pada CV. XYZ’, Jurnal Ensintech, vol. 7, no. 3, pp. 85–92, 2021, [Online]. Available: https://ejournal.unma.ac.id/index.php/j-ensitec/article/view/2350

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Heru Noviyanto Firmansyah, Yazid Alwani, Dias Henandra Eka Putra, Rhenal Verdinand, Muhammad Arifin

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

An author who publishes in the J-ENSITEC (Journal of Engineering and Sustainable Technology) agrees to the following terms:

- Author retains the copyright and grants the journal the right of first publication of the work simultaneously licensed under the Creative Commons Attribution-ShareAlike 4.0 License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this journal

- The author is able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book) with the acknowledgment of its initial publication in this journal.

- The author is permitted and encouraged to post his/her work online (e.g., in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of the published work